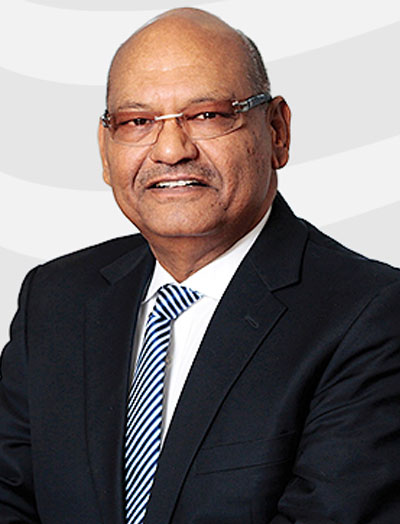

Anil Agarwal

Anil Agarwal

(Age 39 Yr. )

Personal Life

| Education | Bachelor of Engineering |

| Religion | Hinduism |

| Nationality | Indian |

| Profession | Businessman, industrialist |

| Place | Patna, Bihar, India |

Physical Appearance

| Height | 5 feet 10 inches |

| Weight | 82 kg (approx.) |

| Eye Color | Dark Brown |

| Hair Color | Bald |

Family

| Parents | Father: Dwarka Prasad Agarwal |

| Marital Status | Married |

| Spouse | Kiran Agarwal |

| Childern/Kids | Son: Agnivesh Daughter: Priya |

| Siblings | Brother: Navin Agarwal |

Favourite

| Color | Black and White |

| Food | Indian food |

Anil Agarwal is an Indian billionaire businessman who is the founder and chairman of Vedanta Resources Limited. He controls Vedanta Resources through Volcan Investments, a holding vehicle with a 100% stake in the business. Agarwal's family have a net worth of $4 billion.

Early life

Agarwal was born and brought up in a Marwadi family in Patna, Bihar, India. His father Dwarka Prasad Agarwal had a small aluminium conductor business. He studied at Miller High School, Patna. He decided to join his father's business, making aluminium conductors instead of going to university. At 19, he left Patna for Mumbai (then Bombay) to explore career opportunities.

Career

In the mid-1970s, he began trading in scrap metal, collecting it from cable companies in other states and selling it in Mumbai. In 1976, Anil Agarwal acquired Shamsher Sterling Corporation, a manufacturer of enameled copper, among other products, with a bank loan. For the next 10 years, he ran both businesses. In 1986, he set up a factory to manufacture jelly-filled cables, creating Sterlite Industries. He soon realized that the profitability of his business was volatile, fluctuating with the prices of his raw materials: copper and aluminium. So he decided to control his input costs by manufacturing the metals instead of buying them.

In 1993, Sterlite Industries became the first private sector company in India to set up a copper smelter and refinery. In 1995, Sterlite Industries acquired Madras Aluminium, a 'sick' company that had been shut down for 4 years and held by the Board for Industrial and Financial Reconstruction (BIFR). The next step of the backward integration process seemed natural: mining.

His first opportunity came when the government announced a disinvestment program. In 2001, he acquired 51 percent in Bharat Aluminium Company (BALCO) for an amount of INR 551.50 crore, a public sector undertaking; in the very next year, he acquired a majority stake (nearly 65 per cent) in state-run HZL(Hindustan Zinc Limited). Both the companies were considered sleepy and inefficient mining firms.

To access international capital markets, Anil Agarwal and his team incorporated Vedanta Resources Plc in 2003 in London. At the time of its listing, Vedanta Resources Plc, was the first Indian firm to be listed on London Stock Exchange, on 10 December 2003, Vedanta Resources became the parent company of the group through a process of internal restructuring of group companies and their shareholding.

In 2004 Vedanta Resources Plc announced a global bond offering and acquired Konkola Copper Mines in Zambia, Africa. In 2007, Vedanta Resources acquired a controlling stake in Sesa Goa Limited, India's largest producer-exporter of iron ore, and in 2010, the company acquired South African miner Anglo American's portfolio of zinc assets in Namibia, Ireland and South Africa. The next year, Vedanta Resources acquired controlling stake in Cairn India, India's largest private sector oil-producing firm. The merger of Sesa Goa and Sterlite Industries was announced in 2012, as part of the Vedanta Group's consolidation.

Vedanta Resources, headquartered in London, is a globally diversified natural resources conglomerate, with interests in zinc, lead, silver, copper, iron ore, aluminium, power generation, and oil and gas. The greatest share of its assets, however, is in India; Agarwal lives in London.

In October 2017, it was announced that Agrawal's Volcan Holdings Plc had taken a 19% stake in mining company Anglo American, making him biggest shareholder of the company.

According to The Sunday Times Rich List in 2020 his net worth was estimated at £8.5 billion.

According to Forbes Vedanta and Foxconn in 2022 will jointly invest about $20 billion to build semiconductor and display plants in the Indian state of Gujarat, with Vendanta having 60% stakes in the venture.

Investments in India

Anil Agarwal through his Vedanta group have made several investments in various Indian states

He had invested ₹80000 crore earlier in Odisha, with an additional investment of more than ₹25000 crore for expansion of its Aluminium, Ferrochrome and mining business in the state. Vedanta is contributing nearly 4% of Odisha's GDP.

Vedanta invested ₹1.54 lakh crore in Gujarat in association with Foxconn (2022), for their new semiconductor plant.

Philanthropy

In 1992, Anil Agarwal created the Vedanta Foundation as the vehicle through which the group companies would carry out their philanthropic programs and activities. In the financial year 2013–14, the Vedanta group companies and the Vedanta foundation invested US$49.0 million in building hospitals, schools and infrastructure, conserving the environment and funding community programs that improve health, education and livelihood of over 4.1 million people. The initiatives were undertaken in partnership with the government and non-governmental organizations (NGOs). Among his inspirations, Agarwal counts Andrew Carnegie and David Rockefeller who built public works with their fortunes, and Bill Gates. The activities funded by his philanthropy are focused on child welfare, women empowerment and education.

Anil Agarwal was ranked second in Hurun India Philanthropy List 2014 for his personal donation of Rs. 1,796 crore (about $360 million). He was ranked 25th in the Hurun India Rich List with a personal fortune of 12,316cr.

In 2015, the Vedanta group in partnership with Ministry for Women and Child development inaugurated the first "Nand Ghar" or modern anganwadi, of the 4,000 planned to set up. Agarwal has pledged to donate 75% of his family's wealth to charity, saying he was inspired by Bill Gates. In 2021, the Anil Agarwal Foundation pledged to spend Rs 5000 crore on social impact programmes focused on nutrition, women & child development, healthcare, animal welfare and grass root level sports over the course of 5 years.

Honours and awards

The Economic Times, Business Leader Award – 2012

Mining Journal Lifetime Achievement Award - 2009

The Ernst & Young Entrepreneur of the Year - 2008

The Asian Awards Entrepreneur of the Year - 2016

The One Globe Forum (OGF) award for creating a strong social impact for the communities the group operates in, and for initiatives such as Nand Ghar - 2018

Dr. Thomas Cangan Leadership Award– 2013, Faculty of Management Studies – Institute of Rural Management, Jaipur (FMS-IRM)

The Asian Achievers Awards - Lifetime Achievement Award 2019

Asian Business Philanthropy Award 2021

CIF Global Indian Award 2022, Toronto Canada 2022

Vedanta was stripped of international safety awards after it was found it failed to declare its involvement one of the worst industrial accidents in India's history.